The British-Indian economic landscape is witnessing an unprecedented transformation as UK PM Starmer embarks on his most ambitious trade mission to date, leading a record-breaking Starmer India visit with 125 high-profile delegates to Mumbai. This historic diplomatic and commercial expedition, spanning October 8-9, 2025, represents the largest British business delegation ever to set foot on Indian soil, signalling a new era of economic cooperation between the world’s fifth and sixth-largest economies.

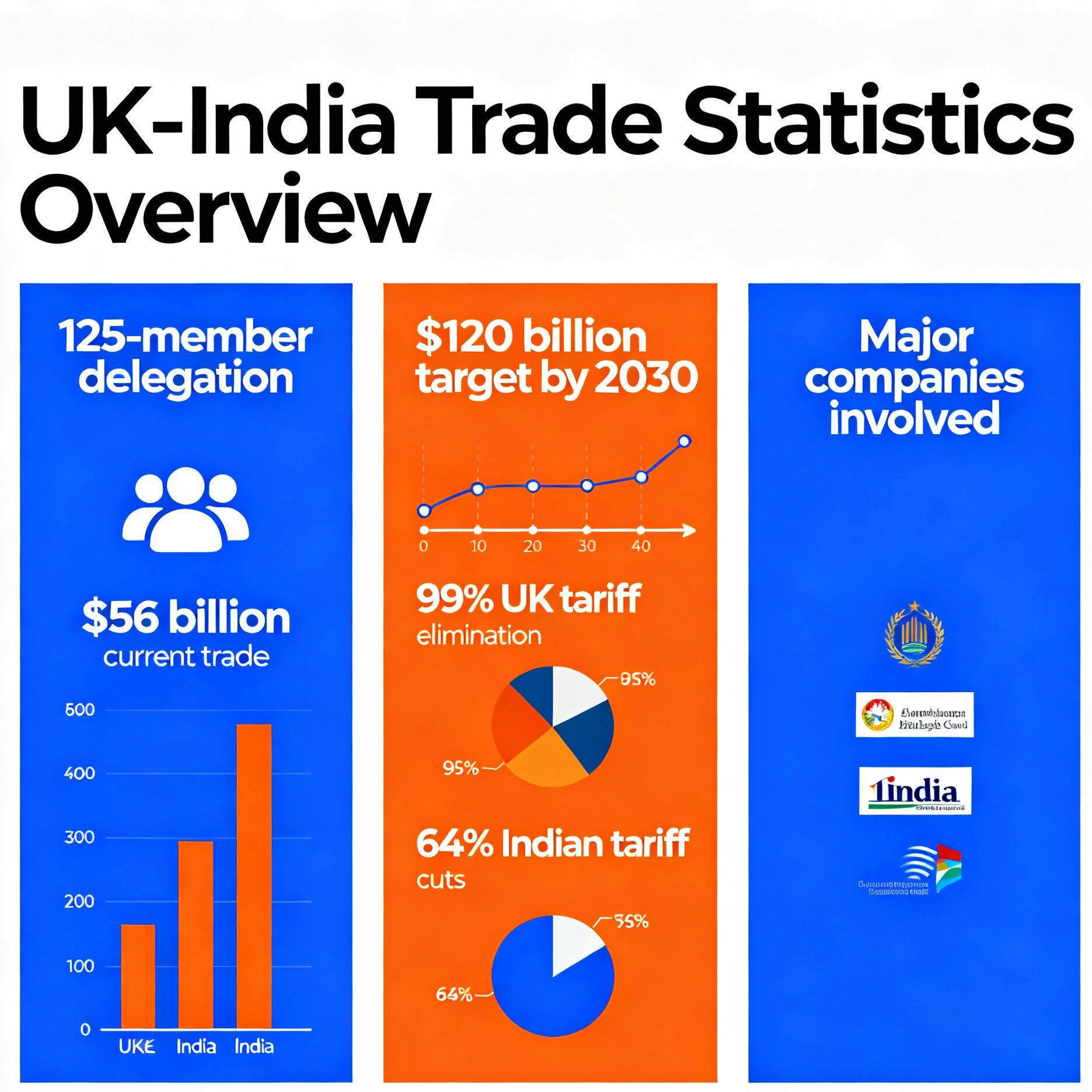

Starmer’s carefully orchestrated Mumbai-centric itinerary deliberately bypasses traditional diplomatic protocols, choosing India’s financial capital over New Delhi to underscore his administration’s laser focus on accelerating trade implementation. The Starmer India visit comes at a critical juncture, just three months after both nations signed the historic Comprehensive Economic and Trade Agreement (CETA) in July 2025, with ambitious targets to double bilateral trade from the current $56 billion to $120 billion by 2030.

This unprecedented diplomatic-commercial convergence is driven by mutual necessity and opportunity. For Starmer, facing domestic approval ratings of just 22%, the mission represents a crucial opportunity to demonstrate tangible economic achievements to British voters increasingly sceptical of his economic policies.

The Historic Delegation: Britain’s Economic Powerhouse on Display

The magnitude and composition of the Starmer India visit delegation reflects the unprecedented strategic importance both nations place on accelerating their economic partnership. The 125-member contingent represents a carefully curated cross-section of British economic might, including CEOs from FTSE 100 companies, startup entrepreneurs, university vice-chancellors, and cultural institution leaders.

Corporate Titans Leading the Charge: The delegation’s heavyweight corporate lineup reads like a who’s who of British industry, featuring executives from Rolls-Royce, British Airways, Standard Chartered, Barclays, British Telecom, Diageo, and the London Stock Exchange. These companies collectively represent hundreds of billions in market capitalisation and millions of employees worldwide, underlining the serious commercial intent behind Starmer’s diplomatic mission.

Beyond Traditional Trade: What sets this delegation apart from typical trade missions is its holistic approach to bilateral cooperation. University vice-chancellors are exploring educational partnerships and research collaborations, while cultural leaders are negotiating entertainment industry tie-ups. The visit to Yash Raj Films studios, resulting in commitments to produce three Bollywood films in the UK, exemplifies this multi-dimensional approach to economic cooperation.

Strategic Sectoral Focus: The delegation’s composition strategically targets sectors where UK-India synergies are strongest: financial services, telecommunications, aerospace, pharmaceuticals, education, and creative industries. This alignment reflects both countries’ competitive advantages, India’s massive domestic market and growing middle class, and Britain’s expertise in high-value services, advanced manufacturing, and innovation ecosystems.

Diplomatic Heavy-Hitters: Accompanying Starmer are key cabinet members, including Secretary of State for Business and Trade Peter Kyle, Secretary of State for Scotland Douglas Alexander, and Minister for Investment Jason Stockwood. This high-level political representation ensures that commercial discussions are backed by immediate policy-making authority.

The CETA Framework: Revolutionising UK-India Trade Architecture

At the heart of the Starmer India visit lies the Comprehensive Economic and Trade Agreement (CETA), signed just three months prior during Modi’s reciprocal visit to London. This landmark trade pact represents more than a decade of negotiations and is poised to fundamentally reshape economic relations between the two nations.

Tariff Elimination Bonanza: The CETA’s most immediate impact comes through aggressive tariff reductions that will slash trade barriers across hundreds of product categories. The UK has committed to eliminating tariffs on 99% of Indian exports, providing unprecedented market access for Indian textiles, leather goods, marine products, gems and jewellery, and engineering goods. Conversely, India will reduce tariffs on 64% of British exports, with 85% of these becoming completely tariff-free over the next decade.

Whisky Wars Resolution: One of the most symbolically significant aspects of the CETA involves resolving the long-standing “whisky wars” that have hindered UK spirits exports to India. Indian tariffs on UK whisky and gin, currently standing at a prohibitive 150%, will be reduced to 75% immediately upon implementation, with further staged reductions to 40% over the following decade. Given that UK whisky exports to India were worth over £200 million annually in 2022 despite these barriers, the tariff reductions could potentially triple or quadruple this trade volume.

Automotive Industry Transformation: The agreement addresses one of the most contentious aspects of UK-India trade, automotive tariffs that currently exceed 100% for British car exports. Under the CETA framework, these will be reduced to just 10% within quota limits, initially applying to internal combustion engine vehicles before transitioning to electric and hybrid vehicles.

Services Liberalisation: Beyond goods, the CETA significantly liberalises trade in services across 36 sectors under Contractual Service Suppliers and 16 under Independent Professionals. This includes IT services, research and development, hospitality, and creative industries, enabling greater mobility for professionals, including software engineers, consultants, chefs, yoga instructors, and artists.

Government Procurement Access: For the first time, UK companies will gain access to India’s massive government procurement markets in transport, healthcare, and energy sectors. Given India’s ambitious infrastructure development plans and the scale of public sector spending, this represents a potentially transformative opportunity for British businesses.

Strategic Economic Imperatives: Why Now for Both Nations

The timing of the Starmer India visit reflects converging strategic imperatives that make enhanced UK-India economic cooperation not just beneficial but essential for both nations’ long-term prosperity and global competitiveness.

Britain’s Post-Brexit Positioning: For the UK, the CETA represents the largest trade agreement negotiated since Brexit, providing a crucial proof point that Britain can forge independent trade relationships outside the European Union framework. With Starmer calling it “the biggest deal that we’ve struck since we left the EU,” the agreement serves both economic and political functions in demonstrating Brexit’s potential benefits to sceptical British voters.

India’s Diversification Strategy: India’s engagement reflects its strategic imperative to diversify trade relationships amid shifting global dynamics. As tensions with China persist and the US imposes selective tariffs on Indian goods, the UK emerges as an attractive alternative partner offering advanced technology, financial services, and market access without the geopolitical complications.

Demographic and Economic Convergence: Both nations face complementary economic challenges that bilateral cooperation can address. The UK’s ageing population and skills shortages in key sectors align perfectly with India’s youthful demographic profile and expanding education system. Meanwhile, India’s infrastructure development needs match Britain’s expertise in engineering, financial services, and project management.

Market Access Revolution: Sectoral Transformation Opportunities

The Starmer India visit and accompanying CETA implementation promise to revolutionise market access across multiple sectors, creating opportunities for businesses that have previously found India’s market difficult to penetrate due to high tariffs and regulatory barriers.

Financial Services Expansion: British financial services firms, representing one of the UK’s most competitive export sectors, stand to benefit enormously from enhanced market access provisions. With India’s financial sector undergoing rapid digitalisation and the growing middle class demanding sophisticated financial products, UK banks, insurance companies, and fintech firms are positioned to capture significant market share.

Pharmaceutical and Healthcare Opportunities: The UK’s advanced pharmaceutical sector, including both large multinational corporations and innovative biotech companies, will benefit from reduced tariffs and streamlined regulatory processes. Given India’s massive healthcare market and growing demand for advanced medical devices, this sector represents one of the highest-potential areas for UK exports.

Educational Services Export: British universities, already popular among Indian students, will benefit from enhanced visa provisions and mutual recognition agreements that facilitate academic exchange. The delegation’s inclusion of university vice-chancellors signals intent to expand this lucrative export market significantly.

Creative Industries and Cultural Exchange: The entertainment industry cooperation announced during Starmer’s YRF studio visit represents just the beginning of expanded cultural and creative collaboration. British expertise in film production, television content, and digital media aligns with India’s rapidly growing entertainment consumption and production capabilities.

Investment Flows and Capital Mobility Enhancement

Beyond traditional trade, the Starmer India visit has catalysed significant investment commitments that demonstrate the deepening financial integration between both economies.

Record Investment Commitments: During the visit, 64 Indian companies collectively committed £1.3 billion ($1.73 billion) in new investments in the UK, though detailed breakdowns of these commitments remain confidential. These investments span multiple sectors and represent both greenfield projects and expansions of existing operations.

Bilateral Infrastructure Development: The agreement to establish connectivity and innovation centres in both countries will facilitate technology transfer and joint research initiatives. These facilities will serve as testing grounds for emerging technologies and platforms for collaborative innovation projects.

Critical Minerals Partnership: The creation of a critical minerals industry guild addresses both countries’ concerns about supply chain resilience in an era of geopolitical uncertainty. This partnership could prove especially significant as both nations transition to electric vehicles and renewable energy systems.

Social Security Agreement Implications: The negotiated Social Security Agreement, which exempts professionals on short-term assignments from dual contributions, significantly reduces the cost of cross-border labour mobility. This provision particularly benefits the IT services sector, where Indian companies frequently deploy professionals to UK client locations.

Political Stakes and Domestic Considerations

The Starmer India visit carries significant political implications for both leaders, with domestic considerations playing crucial roles in shaping the bilateral agenda.

Starmer’s Approval Rating Challenge: With British polls showing only 22% favourable approval for Starmer’s leadership, the Prime Minister desperately needs tangible achievements to demonstrate his government’s competence. The trade mission represents an opportunity to showcase concrete economic benefits that can be directly attributed to his administration’s diplomatic efforts.

Modi’s Global Leadership Aspirations: For Modi, hosting such a high-profile trade delegation reinforces India’s position as an indispensable global economic partner. The Prime Minister has consistently emphasised India’s role as “a beacon of stability in a tumultuous world,” and successful economic partnerships with major Western economies support this narrative.

Brexit Vindication Narrative: For the UK, the successful implementation of the CETA provides crucial evidence that Britain can thrive outside the European Union framework. Conservative critics of Brexit require concrete proof that an independent trade policy can deliver superior outcomes to EU membership.

Technology Cooperation and Innovation Corridors

The Starmer India visit has established technology cooperation as a cornerstone of the bilateral relationship, with commitments to joint AI centres and connectivity innovation hubs representing potentially transformative long-term initiatives.

Artificial Intelligence Partnership: The joint AI centre initiative addresses both countries’ recognition that artificial intelligence capabilities will determine future economic competitiveness. Britain’s strength in AI research, particularly in areas like machine learning and neural networks, complements India’s massive data resources and growing AI applications market.

5G and Telecommunications Infrastructure: Cooperation on advanced communication technologies, including 5G and future 6G development, reflects shared concerns about technological sovereignty and supply chain security. Both countries seek alternatives to Chinese telecommunications equipment, creating opportunities for joint development of secure communications infrastructure.

Fintech Innovation: The Global Fintech Fest, where both leaders delivered keynote addresses, symbolises the importance of financial technology cooperation. Britain’s role as a global fintech hub and India’s rapid adoption of digital payments and banking services create natural synergies for collaborative innovation.

Cultural and Educational Dimensions

The Starmer India visit has elevated cultural and educational cooperation to the same strategic level as traditional economic partnerships, recognising that long-term bilateral relationships require deeper people-to-people connections.

Bollywood-UK Film Production: The commitment to produce three Bollywood films in the UK, announced during Starmer’s YRF studio visit, represents more than symbolic cultural exchange. The UK’s film production infrastructure, tax incentives, and technical expertise complement India’s creative content and global distribution capabilities.

Educational Exchange Expansion: The inclusion of university vice-chancellors in the delegation signals intent to dramatically expand educational cooperation beyond the already substantial Indian student population in UK universities. Mutual recognition of academic credentials, joint degree programs, and collaborative research initiatives could create new revenue streams for educational institutions.

Conclusion: Transformational Partnership or Diplomatic Theatre?

The Starmer India visit represents either the beginning of a transformational economic partnership or an elaborate exercise in diplomatic theatre designed to serve short-term political needs for both leaders. The ultimate verdict will depend on the success of implementation over the coming months and years.

The fundamentals supporting deeper UK-India cooperation are compelling: complementary economic structures, shared democratic values, historical connections, and mutual strategic interests in diversifying trade relationships. The CETA framework provides a solid foundation for expanded economic integration, with tariff reductions and market access provisions that address long-standing barriers to bilateral trade.

However, the ambitious targets, doubling trade to $120 billion by 2030, require more than diplomatic agreements and photo opportunities. Success depends on sustained implementation efforts, business community engagement, and political commitment that survives electoral cycles in both countries.

The Starmer India visit has certainly elevated the relationship’s profile and created momentum for accelerated cooperation. The record-breaking delegation size, high-level political participation, and comprehensive sector coverage demonstrate serious intent from both sides. The immediate investment commitments and concrete partnership announcements provide tangible early evidence of the mission’s success.

Yet sceptics will note that trade agreements often promise more than they deliver, particularly when implementation requires complex regulatory changes and business behaviour modifications. The political stakes for both leaders add another layer of complexity, with Starmer’s need for foreign policy achievements and Modi’s global leadership aspirations creating incentives for overselling short-term benefits.

Ultimately, the UK PM Starmer’s India visit will be judged not by the enthusiasm of October 2025 but by the trade statistics, investment flows, and partnership developments of 2027 and beyond. As both leaders return to their domestic challenges, the true test begins: translating diplomatic agreements into business realities and mutual admiration into sustained economic partnership.