The United States has entered its third day of the first US government shutdown in seven years, creating a cascade of economic disruptions that extend far beyond Washington D.C.’s political theatrics. As Republicans and Democrats remain locked in an unprecedented budget stalemate, the ripple effects are already manifesting in weakening dollar values, disrupted economic data flows, and mounting pressure on the Federal Reserve to accelerate interest rate cuts.

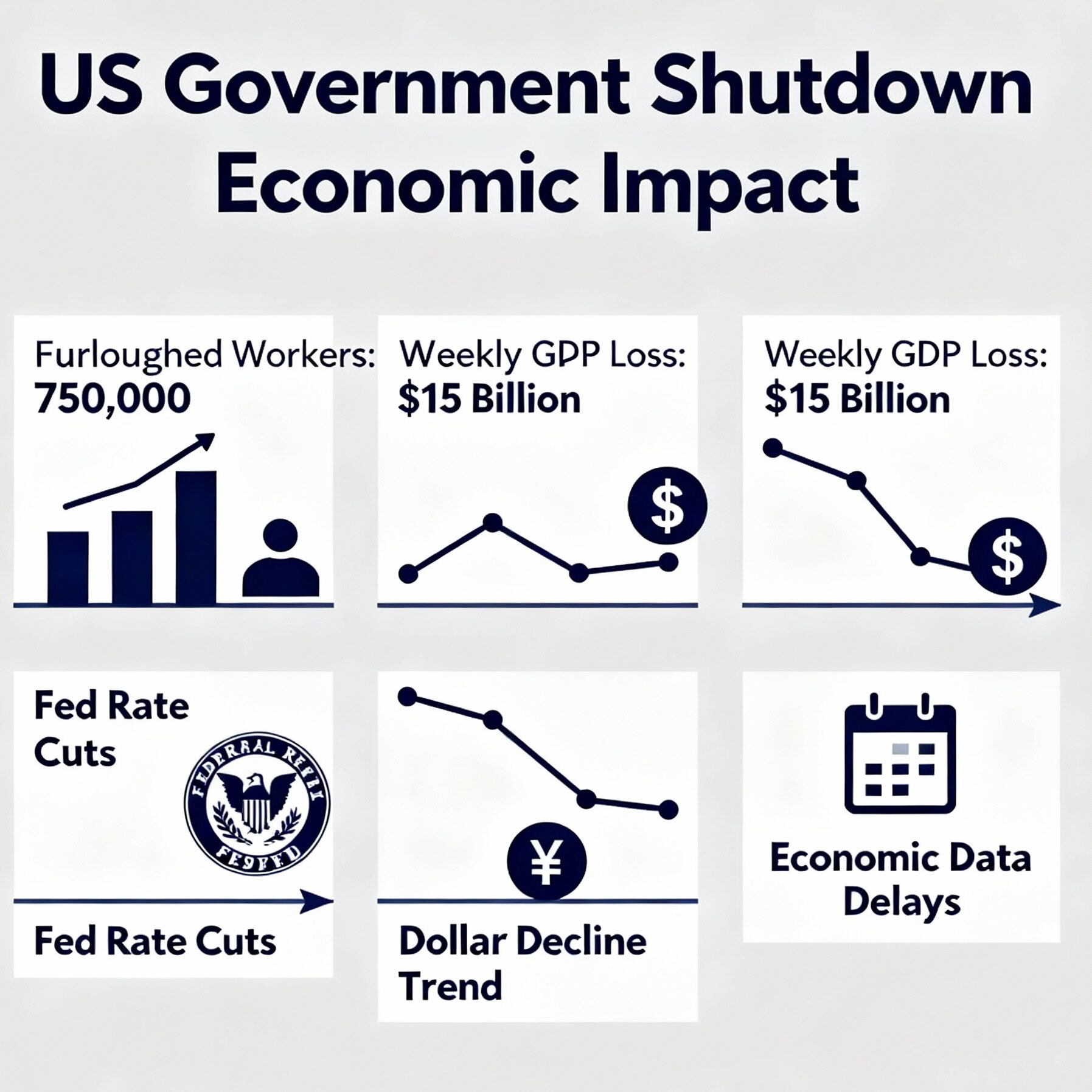

With over 750,000 federal employees furloughed and essential workers labouring without pay, this shutdown represents more than a temporary inconvenience; it’s emerging as a potential catalyst for significant economic upheaval that could reshape monetary policy and global market dynamics for months to come.

The Unprecedented Scale of Economic Disruption

Unlike previous shutdowns that primarily affected government operations, the current crisis is unfolding during a particularly vulnerable economic moment. The Congressional Budget Office estimates that the US government shutdown could cost the American economy approximately $15 billion in gross domestic product for each week it continues, with analysts warning that a month-long shutdown could result in 43,000 additional unemployed Americans.

The shutdown’s timing couldn’t be worse. The U.S. economy is already grappling with uncertainty from various fronts: a struggling labour market showing signs of deceleration, persistent inflationary pressures despite recent cooling, and growing concerns about the sustainability of economic growth. Federal Reserve Chair Jerome Powell has recently described the current economic environment as a “turbulent period” that requires careful navigation by policymakers.

This economic fragility means that what might have been a manageable disruption during stronger times now threatens to become a more serious crisis. The shutdown is occurring at what economists describe as a potential “inflexion point” for the American economy, where policy decisions could tip the balance between continued growth and potential recession.

Federal Reserve Flying Blind: The Data Dilemma

One of the most concerning aspects of the government shutdown at the Federal Reserve is the complete halt of crucial economic data releases that the central bank relies on for policy decisions. The Bureau of Labour Statistics has suspended publication of key reports, including:

Critical Employment Data: The monthly jobs report, originally scheduled for release on Friday, October 4th, has been indefinitely postponed. This report typically provides essential insights into hiring trends, unemployment rates, and wage growth; all crucial factors in Federal Reserve decision-making.

Inflation Metrics: Consumer Price Index (CPI) data, which measures inflation across the economy, will be delayed. This information is fundamental to the Fed’s dual mandate of maintaining price stability and full employment.

GDP Growth Indicators: Various economic productivity measures and growth indicators from the Bureau of Economic Analysis are on hold, leaving policymakers without real-time assessments of financial performance.

Kenneth Kuttner, a professor of economics at Williams College who studies central bank policy, told ABC News: “This is probably the worst time for the Fed to be flying blind. The economy could be at an inflexion point”. This sentiment reflects the broader concern that the Federal Reserve may need to make critical interest rate decisions without access to the comprehensive data it typically relies upon.

The information vacuum is particularly problematic because the Fed has already signalled that incoming economic data would play an “even more critical role than usual” in determining future monetary policy moves. Chair Jerome Powell emphasised after September’s rate cut that officials would be “assessing things on a meeting-by-meeting basis” and “watching the data closely”.

Dollar Weakness Accelerates Amid Shutdown Uncertainty

The US dollar weakness has become one of the most visible immediate consequences of the government shutdown, with currency markets responding negatively to the political impasse and its economic implications. The Bloomberg Dollar Spot Index has declined for four consecutive days, falling 0.2% as the shutdown entered its second day, with the Japanese yen leading gains among G-10 currencies against the greenback.

MUFG Bank Assessment: One of the world’s largest financial institutions has issued warnings about prolonged dollar weakness, suggesting that an extended shutdown could prompt the Federal Reserve to implement more aggressive rate cuts, potentially as early as October and again in December. When interest rates fall, the return on dollar-denominated assets decreases, making the currency less attractive to international investors.

Historical Precedent: Government shutdowns have historically exerted downward pressure on the dollar, and options market positioning indicates that traders are preparing for additional weakness this time around. Risk reversals, which measure the difference between bullish and bearish positioning, show expectations for continued dollar declines in the coming month.

Currency strategists note that the dollar’s weakness extends beyond immediate shutdown concerns. Lee Hardman, senior currency analyst at MUFG, explains: “The dollar can weaken over the next six to twelve months as the Fed continues to cut rates while other major central banks like the ECB suggest they are nearing the end of their rate-cutting cycles”.

Federal Reserve Rate Cut Expectations Solidify

Market expectations for Federal Reserve rate cuts have crystallised dramatically since the shutdown began, with traders now assigning a 97-98% probability to a quarter-point rate reduction at the Fed’s October 28-29 meeting. This represents a significant increase from pre-shutdown expectations and reflects growing consensus that economic uncertainty will compel the central bank to provide additional monetary stimulus.

Bank of America’s Forecast Revision: Major Wall Street institutions are adjusting their predictions in response to shutdown developments. Bank of America Global Research moved its Fed rate cut forecast to October from December, citing signs of a softening labour market and the challenges posed by data disruptions.

Alternative Data Sources: In the absence of official government statistics, Federal Reserve officials must rely on private sector data and regional Fed surveys. Recent private employment data from ADP showed a concerning decline of 32,000 jobs in September, contradicting expectations of 50,000 job gains. This private data suggests a weakening of the labour market, which supports the case for rate cuts.

Dual Mandate Concerns: The Fed faces the challenging task of balancing its dual mandate of price stability and full employment during a period of limited data visibility. Chicago Fed President Austan Goolsbee noted the difficulty, stating: “The uptick of inflation that we’ve been seeing, coupled with the jobs, payroll numbers deteriorating, has put the Fed in a bit of a sticky spot”.

Krishna Guha from Evercore ISI observed: “The US government shutdown and related data blackouts push what we thought was already a high likelihood of a Fed ease in October even closer to a certainty”.

Economic Productivity and GDP Impact Analysis

The government shutdown’s economic impact extends beyond immediate government operations to affect broader economic productivity and growth. Economists estimate that each week of shutdown subtracts approximately 0.1 to 0.2 percentage points from annualised GDP growth through reduced government activity, with potential additional impacts through sentiment channels.

Direct Economic Costs: The White House Council of Economic Advisers estimates that a month-long shutdown would reduce consumer spending by $30 billion, with half of that impact coming from direct effects on federal workers and their families, and the remainder from broader economic confidence effects.

Small Business Impact: Federal loan programs for small businesses face delays, potentially constraining business investment and expansion during a critical economic period. Mortgage applications are expected to decline as processing delays affect housing market activity.

Historical Context: The 2018-2019 shutdown, which lasted 35 days, resulted in an $11 billion reduction in economic output according to Congressional Budget Office estimates, including $3 billion in permanent losses that were never recovered. The current shutdown occurs in a more fragile economic environment, potentially amplifying these negative effects.

Market Response and Political Escalation

Financial markets have shown mixed responses to the US government shutdown, with some sectors remaining relatively stable while others exhibit clear signs of concern. The stock market showed initial resilience, with some indices even posting gains on the first day of the shutdown, reflecting investor expectations that the political impasse would be resolved relatively quickly.

Bond Market Dynamics: U.S. Treasury yields have declined as investors seek safe-haven assets, though the overall impact on bond markets remains moderate since the shutdown doesn’t affect Treasury Department operations or debt issuance. However, analysts note that Treasury bill issuance may decrease slightly as financing needs are reduced during the shutdown period.

Trump’s Aggressive Stance: President Donald Trump’s approach to the current shutdown differs markedly from previous instances, with experts noting a more aggressive stance that raises the stakes significantly. Trump has threatened mass federal employee layoffs beyond traditional furloughs, suggesting that some temporary job losses could become permanent, a development that would dramatically escalate the economic impact.

$26 Billion Funding Freeze: The administration has already implemented a $26 billion freeze on federal funding for Democratic-leaning states, demonstrating willingness to use shutdown leverage for broader political objectives beyond budget negotiations.

Labour Market and Employment Effects

The government shutdown’s impact on employment extends beyond the immediate furloughing of federal workers to broader labour market effects that could influence Federal Reserve policy decisions. With approximately 750,000 federal employees facing unpaid leave and essential workers labouring without compensation, the shutdown creates immediate income disruption for a significant portion of the workforce.

Federal Employee Impact: Unlike previous shutdowns, current threats of permanent layoffs rather than temporary furloughs could create lasting unemployment rather than recoverable income delays. This distinction is crucial for understanding the shutdown’s potential economic persistence.

Contractor and Private Sector Effects: Federal contractors often cannot recover lost income from shutdown periods, creating immediate and permanent income reductions for private sector workers dependent on government contracts. This impact typically extends throughout the supply chain serving federal agencies.

The employment effects are particularly concerning given existing labour market softness, with recent private payroll data showing unexpected job losses rather than gains in September.

Global Economic Ramifications

The US government shutdown effects extend well beyond American borders, influencing global economic dynamics and international monetary policy decisions. As the world’s largest economy and issuer of the primary global reserve currency, U.S. political and economic instability creates worldwide ripple effects.

International Dollar Demand: Weakening confidence in U.S. governance and economic impact could accelerate ongoing shifts away from dollar-denominated transactions and reserves, particularly among countries seeking to reduce exposure to U.S. political volatility.

Central Bank Coordination: International central banks may need to adjust their own monetary policies in response to Federal Reserve actions taken during the shutdown period, potentially creating global coordination challenges.

Future Outlook and Strategic Implications

As the US government shutdown enters its fourth day with no clear resolution in sight, economists and market analysts are modelling various scenarios and their potential economic implications. The range of possible outcomes varies dramatically based on shutdown duration and the ultimate terms of any resolution.

Market Pricing: Current market positioning suggests investors are preparing for a resolution within 2-3 weeks, but are also hedging against more extended scenarios. The 97% probability assigned to October Federal Reserve rate cuts reflects expectations that economic disruption will be significant regardless of shutdown duration.

Currency Strategy: The continued dollar weakness amid shutdown uncertainty suggests potential opportunities in non-dollar currencies, particularly those backed by central banks approaching the end of their own rate-cutting cycles.

Fixed Income Positioning: Treasury securities may continue benefiting from safe-haven demand despite falling yields, while corporate credit markets could face pressure if shutdown-induced economic weakness materialises.

Conclusion: Navigating Unprecedented Economic Uncertainty

The current US government shutdown represents more than a temporary political impasse; it’s emerging as a significant economic event with far-reaching implications for monetary policy, currency markets, and global financial stability. The combination of economic data disruption, Federal Reserve policy uncertainty, and escalating political brinkmanship creates a uniquely challenging environment for policymakers, investors, and businesses.

The Federal Reserve’s predicament of operating with limited data during a critical economic juncture highlights the interconnectedness of political stability and economic policy effectiveness. As the shutdown continues, the central bank faces mounting pressure to provide economic support through interest rate cuts, even without complete information about the economic impact conditions.

For global markets, the situation underscores ongoing concerns about American political dysfunction and its potential to disrupt international economic stability. The US dollar weakness reflects not just immediate shutdown effects but broader questions about U.S. governance and economic policy predictability.

As this unprecedented crisis unfolds, the ultimate resolution and its timing will likely have lasting implications for American economic policy, Federal Reserve credibility, and global confidence in U.S. economic leadership. The coming weeks will test both the resilience of American economic institutions and the global financial system’s ability to adapt to prolonged uncertainty from the world’s largest economy.